Greg David, The City

This article was originally published on May 10 12:49pm EDT by THE CITY

About 20% of all the office space in Manhattan is either vacant or occupied by a company that is looking for someone to take it off their hands, the highest ever since tracking began in the early 1990s.

Office leasing activity in the city has slowed dramatically in recent months.

More than $16 billion in loans will come due this year. With the Federal Reserve continuing to raise interest rates and banks tightening lending standards, older office buildings simply won’t be able to refinance, and some may default on their loans, throwing their future in doubt.

Even as New York City nears regaining all the jobs lost in the pandemic, its crucial office market is not recovering with the economy. Rather, it is weakening, as remote and hybrid work arrangements keep offices only partly filled and as fears of a recession make companies cautious about making any real estate commitments even if their leases are near expiration.

While much of the problem is rooted in the pandemic, the runup in interest rates over the past year and Albany’s failure to pass legislation to ease the conversion of some of those buildings to residential use, has made the situation even worse.

“The challenge is real, there is no sugarcoating it,” said Andrew Kimball, the president of the city’s Economic Development Corporation and one of the city’s point people on the office issue.

The deterioration of the office market is a threat to the city’s most important source of revenue, the property tax. Adding to the crisis, scores of empty office buildings can no longer command rents sufficient to pay a mortgage and operating cost.

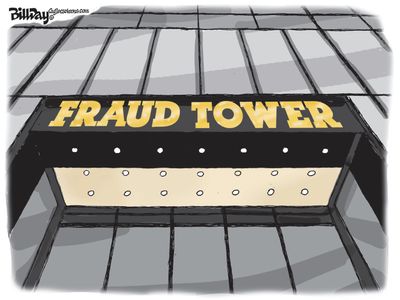

The one bright spot is that demand remains strong for the city’s newest and most expensive office towers. A record number of $100-per-square-foot or higher leases were signed in the first quarter — the average Manhattan office lease is $77 a square foot — as well as a few at more than $200 a square foot.

The deterioration of the office market became clear when real estate brokerage firms released their first quarter reports last month, covering January through March. While each firm calculates the available space somewhat differently, the numbers hit historic highs ranging from 19% to 22%. By comparison, the historical average for Manhattan since 2012 is only 12%, according to Cushman & Wakefield.

New leasing has also slowed dramatically in the last six months. Preliminary data for April shows only 880,000 square feet of new space leased, the lowest level since July 2021, according to Lori Albert, research director of Cushman & Wakefield.

“We expect it to remain that way for a while,” she added. Cushman says the 92 million square feet of available office space is more than every other central business district combined, leaving out Chicago and Washington, D.C.

The reasons are clear to everyone in the industry: seemingly permanent changes in work patterns and the caution companies typically exercise amid economic uncertainty.

“We are at the collision of remote work and the macro economic slowdown,” said Scott Rechler, chief executive of RXR Realty, a prominent landlord and developer.

Office buildings in Manhattan account for about $6.6 billion in direct property taxes each year or 20% of the total, according to city Comptroller Brad Lander. The sector pays several billion more in the commercial rent tax and transfer taxes when buildings are sold.

Credit Tightens

The situation is expected to worsen because of higher interest rates and the lack of action in Albany.

The more than $16 billion in loans coming due this year will have to be refinanced at interest rates as much as three times higher than their current rates given the increases dictated by the Federal Reserve Board’s efforts to fight inflation. While the banks that have failed — Signature, Silicon Valley and First Republic — did not make many commercial loans, the fallout has led other regional banks, the prime source of loans for commercial real estate, to tighten their lending standards.

At best, banks and landlords will work out extensions that will allow the owners to wait until the economy improves and interest rates come down, says Bill Rudin, chief executive of the Rudin Management Company, which owns 16 commercial office buildings with almost 11 million square feet.

The other alternative is that banks take over the buildings, some of which will be so uneconomic they will just sit empty losing value and paying much less in taxes.

The lack of competitiveness of older buildings predates the pandemic, notes Kimball of EDC.

The city’s primary solution was proposed state legislation that would allow some of these buildings to be converted to residential, reducing the amount of office space while increasing housing.

Despite the high costs of conversions, EDC estimates that 20 million square feet could be transformed, creating up to 40,000 new apartments.

The city needed state legislation to relax existing rules that dictated density and even the placement of windows. In response to demands from some elected officials that such conversions include lower-rent affordable apartments, city officials argued that a tax break would be needed to realize that goal.

But the state walked away from negotiations when the legislative leaders insisted on requiring affordable units without the tax break during budget negotiations, state deputy secretary Kathryn Garcia said at a Citizens Budget Commission event last week.

“The plans simply didn’t pencil out,” she said, siding with real estate groups on the need for the tax break if affordable units are required.

Bright Spots

Optimists like Rudin note the city has bounced back before.

“It is an unfortunate moment in time, but if history is any guide we will come back,” he said. “Just in my time there has been the 1987 market crash, 9/11, the dotcom bubble, the 2008 financial crisis, Superstorm Sandy.”

The brightest spot is the most modern office buildings, known as “Class A.” Since the beginning of 2002, almost three-quarters of all new leases are in those buildings, according to research from CBRE.

They are seeking exceptionally high rents. Buildings are offering 15 million square feet at more than $100 a square foot.

Demand remains high. Rechler, who is part of a consortium building a new 100-story building called 175 Park on the site of the former Trump Hyatt which will contain 2.5 million square feet of office space and a 200-room hotel. Around the corner from SL Green’s One Vanderbilt, another top-end new tower, it is expected to open in 2030.

“Since we opened a market suite at One Vanderbilt we have had tenants with leases expiring for 14 million square feet come to see our plans,” he said. “They want to be in the best buildings, close to public transportation, most efficient floor plates, and air and amenities.”

These new buildings, which include the new J.P. Morgan headquarters on Park Avenue, SL Green’s multi-billion-dollar 1 Madison opposite Madison Square Park, and 2 Manhattan West on the Far West Side, will push up the vacancy rate further. Since they are asking high rents, they push up the overall asking rent, even though the rent for older buildings is tumbling.

After those buildings open, there will be a pause since many high-profile projects — such as Vornado’s plan for office towers around Penn Station — have been put on the back burner indefinitely.

Whether the city can take steps to promote new uses for old office buildings or merely has to wait for the economy to improve depends on Albany and the conversions legislation.

“We need absorption in some of these underperforming buildings and we need new tools,” said Kimball.

THE CITY is an independent, nonprofit news outlet dedicated to hard-hitting reporting that serves the people of New York.